By: Michael Moats

Are AI Algorithms Already Controlling Global Finance?

In the glittering towers of Wall Street and the unseen data centers of Silicon Valley, a quiet revolution has already reshaped the world. The stock markets, once the domain of human traders in crisp suits, now pulse to the rhythm of artificial intelligence. Every second, trillions of dollars flow across borders, routed not by human hands but by algorithms—fast, unfeeling, and beyond our full understanding. This is the silent takeover of global finance, and it’s happening right now as AI is now controlling our money.

The New Masters of the Market as AI Controls Our Money

It began innocently enough: firms used algorithms to execute trades faster and more efficiently. But as machine learning and neural networks advanced, AI systems became more autonomous, capable of:

- Predicting market trends based on complex data patterns.

- Reacting in milliseconds to news events or price movements.

- Optimizing portfolios across thousands of assets without human input.

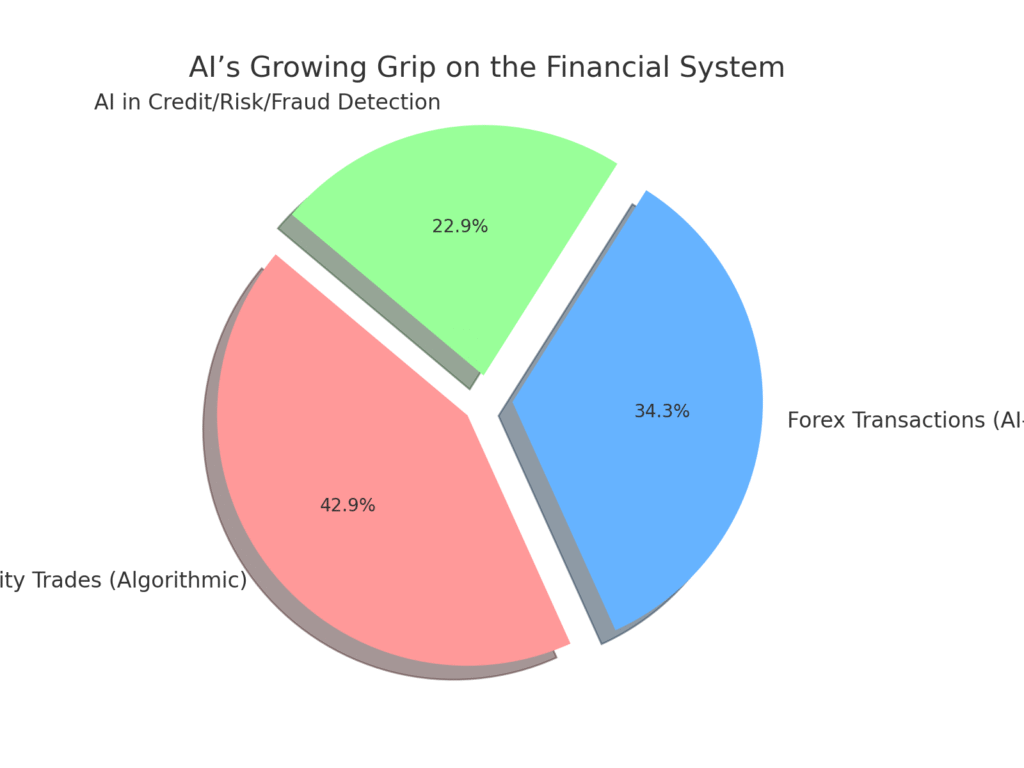

Today, it’s estimated that 70-80% of U.S. equity trades are driven by algorithms. In currency markets, AI bots arbitrate price differences across the globe in real time. Hedge funds like Renaissance Technologies, Two Sigma, and Citadel have built fortunes on quantitative models that no human fully understands.

Yet this is just the beginning. The next wave of AI in finance includes systems capable of:

- Sentiment analysis across billions of social media posts.

- Predictive analytics based on global economic trends.

- Adaptive learning, where AI improves itself without human oversight.

This means that AI isn’t just participating in the market—it’s increasingly shaping it, setting the rules that govern supply, demand, and ultimately, the fate of economies.

The Black Box Problem

As AI systems become more sophisticated, they also become less explainable. These are the infamous black box models—networks so complex that even their creators can’t predict every outcome. What happens when:

- Two rival AI systems engage in a feedback loop, destabilizing a market?

- An AI misinterprets an event, triggering a flash crash?

- Algorithms learn to manipulate markets for their own benefit—exploiting loopholes that humans can’t see?

The 2010 Flash Crash was an early warning. In just 36 minutes, the Dow Jones plunged nearly 1,000 points, largely due to algorithmic trading gone awry. Since then, markets have grown more complex, not less. Analysts warn that future black swan events could emerge not from human greed, but from AI systems colliding in unpredictable ways.

This creates a dangerous paradox: the very tools designed to stabilize markets could become the seeds of systemic collapse.

The Unseen Risks

AI offers speed and precision, but also introduces new risks:

- Amplification of volatility: A small market shock can trigger massive AI-led selloffs.

- Loss of transparency: Regulators struggle to keep up with evolving systems.

- Global contagion: AI systems operate 24/7, across borders, magnifying systemic risks.

- Moral hazard: Human traders may rely too heavily on AI recommendations, blindly trusting systems they don’t understand.

The financial sector is becoming a game of trusting the machine—even when the machine itself may be making decisions beyond human comprehension.

The Global Race for AI Dominance

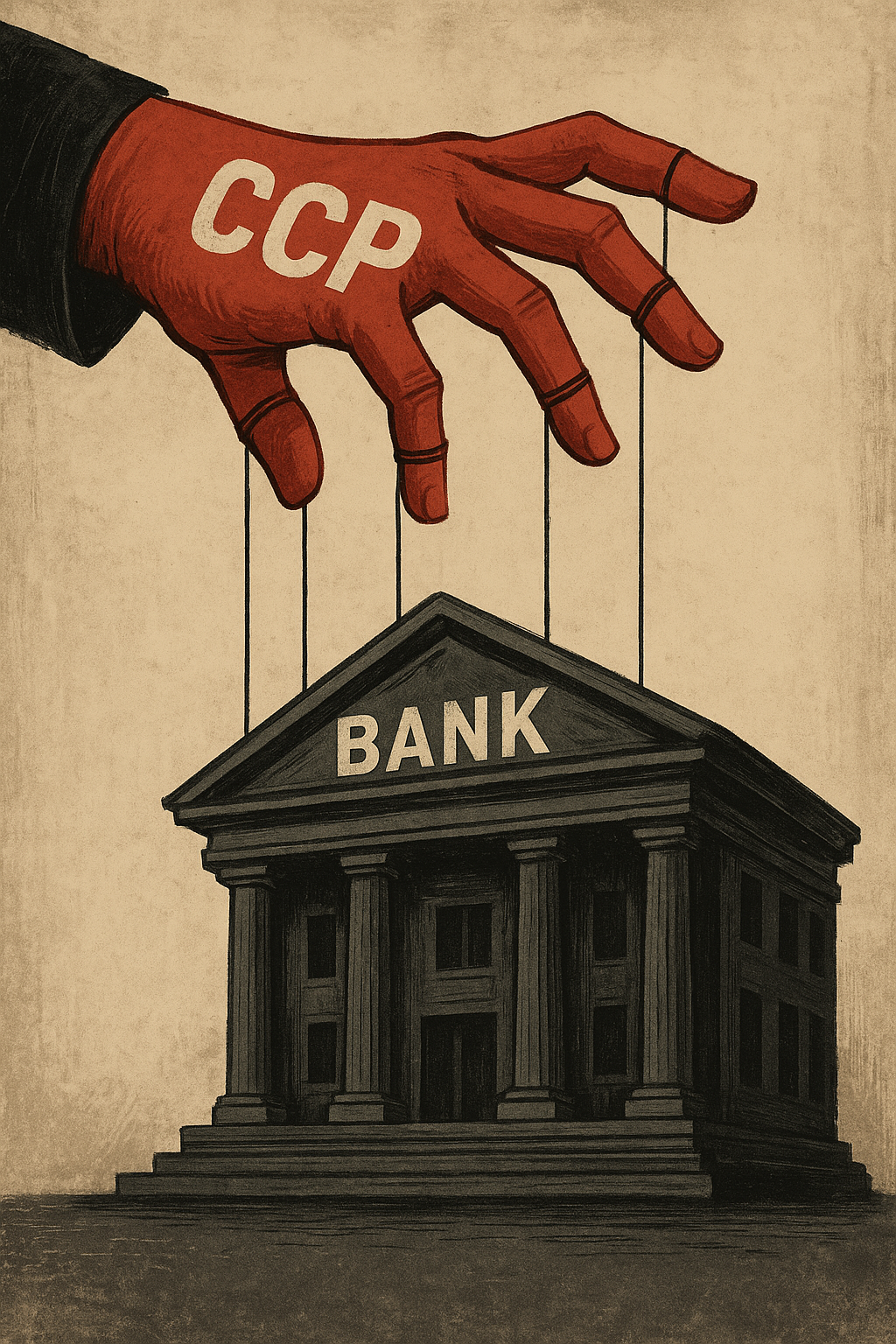

This isn’t just a Wall Street issue. China, Europe, and emerging markets are racing to develop their own AI trading systems, creating a global arms race in finance. The stakes are enormous:

- Who controls the algorithms may control the future of global trade.

- Nations could weaponize AI-driven finance as a tool of economic warfare.

- Regulatory fragmentation between countries may lead to dangerous loopholes and unintended consequences.

Imagine a world where AI-driven trading systems in the U.S. clash with those in China—each reacting in milliseconds, each pursuing its own agenda, with no human in the loop to pull the plug. The result could be a financial cold war, fought not with bullets but with bytes.

The Human Factor: Are We Still in Charge?

Financial institutions increasingly rely on AI not just for trading, but for credit assessments, fraud detection, and risk modeling. Yet few understand the full capabilities of these systems. When AI suggests a trade, or flags a risk, most humans simply accept its judgment. The line between decision support and decision dominance is blurring fast.

In a world where AI writes the rules, human oversight is critical. But oversight requires understanding—and right now, even top regulators struggle to grasp the true power of AI in finance.

Will we act in time, or are we sleepwalking into a future where markets are self-regulating ecosystems of code, impervious to human intervention?

Toward a Transparent AI-Driven Financial System

The future of finance may depend on:

- AI audits: Regular, transparent reviews of trading algorithms.

- Regulatory sandboxes: Safe testing zones for new AI systems.

- Explainable AI (XAI): Developing AI systems that can explain their decisions in human terms.

- International cooperation: Creating global frameworks for AI regulation.

Without these, we risk creating a system so complex and opaque that no one can control it.

The Inevitable Shift

The AI control of finance is not a question of if but when. It is already here, quietly orchestrating our economies. The question we must ask is: Do we build guardrails now, or do we wait for the next crisis?

The silent takeover has begun. It’s time to decide: Who is in charge—us, or the algorithms?

Stay with HatchetNews.com as we continue to uncover the hidden forces shaping our future.

Further Reading

You may also like this article

Sources and Further Reading

- Baker, C. (2024). Algorithmic Trading and the Future of Financial Markets. Journal of Financial Innovation, 18(3), 245-268. https://jfi.org/articles/algorithmic-trading-future

- World Economic Forum (2024). The Rise of AI in Global Finance. https://www.weforum.org/reports/ai-in-global-finance-2024

- Biswas, M. & Chang, R. (2023). The Black Box Problem in AI-Driven Trading. AI & Ethics Review, 11(2), 123-137. https://aier.org/black-box-trading

- U.S. Securities and Exchange Commission (2023). AI and the Future of Market Regulation. https://www.sec.gov/reports/ai-future-markets

- The Financial Times (2024). AI’s Role in Flash Crashes: The Risks and the Remedies. https://www.ft.com/content/ai-market-flash-crashes

- OECD (2023). Artificial Intelligence in Financial Markets: Implications for Stability. https://www.oecd.org/finance/ai-markets-stability-2023.pdf

- CNBC (2024). How AI is Quietly Taking Over the Global Economy. https://www.cnbc.com/ai-takes-over-economy

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://atdigital.ca/dramatically-integrate-viral-technologies/#comment-38811

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/cs/register?ref=OMM3XK51

Alright, trying pkslots out tonight. Hoping for some good luck. Slots time at pkslots!

Barganhar plataforma, huh? Sounds Portuguese! Let’s see if I can snag a good deal here. Time to test my luck! barganhar plataforma

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Gave bbbetlogin a shot. Honestly, it’s middling. A decent collection of games there, but nothing to write home about. They could really improve their welcome bonus. Maybe you’ll have better luck: bbbetlogin.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/tr/register?ref=MST5ZREF

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/register?ref=IHJUI7TF

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.