The Calm Before the Storm

Officially, China’s economy is “resilient.” The state media headlines call it a “soft landing.” The National Bureau of Statistics keeps posting rosy GDP numbers and upbeat forecasts for growth.

But if you know where to listen, you can hear the cracks forming. In rural Henan, depositors gather at locked bank doors, fists pounding on the glass as they’re told their savings are “temporarily frozen.” In Guangdong’s industrial belt, workers whisper about delayed paychecks — and employers who can’t get bridge loans to make payroll. And in the shadows of China’s sprawling ghost cities, rows of unfinished towers stand silent, each an unpaid debt marker nobody wants to tally up.

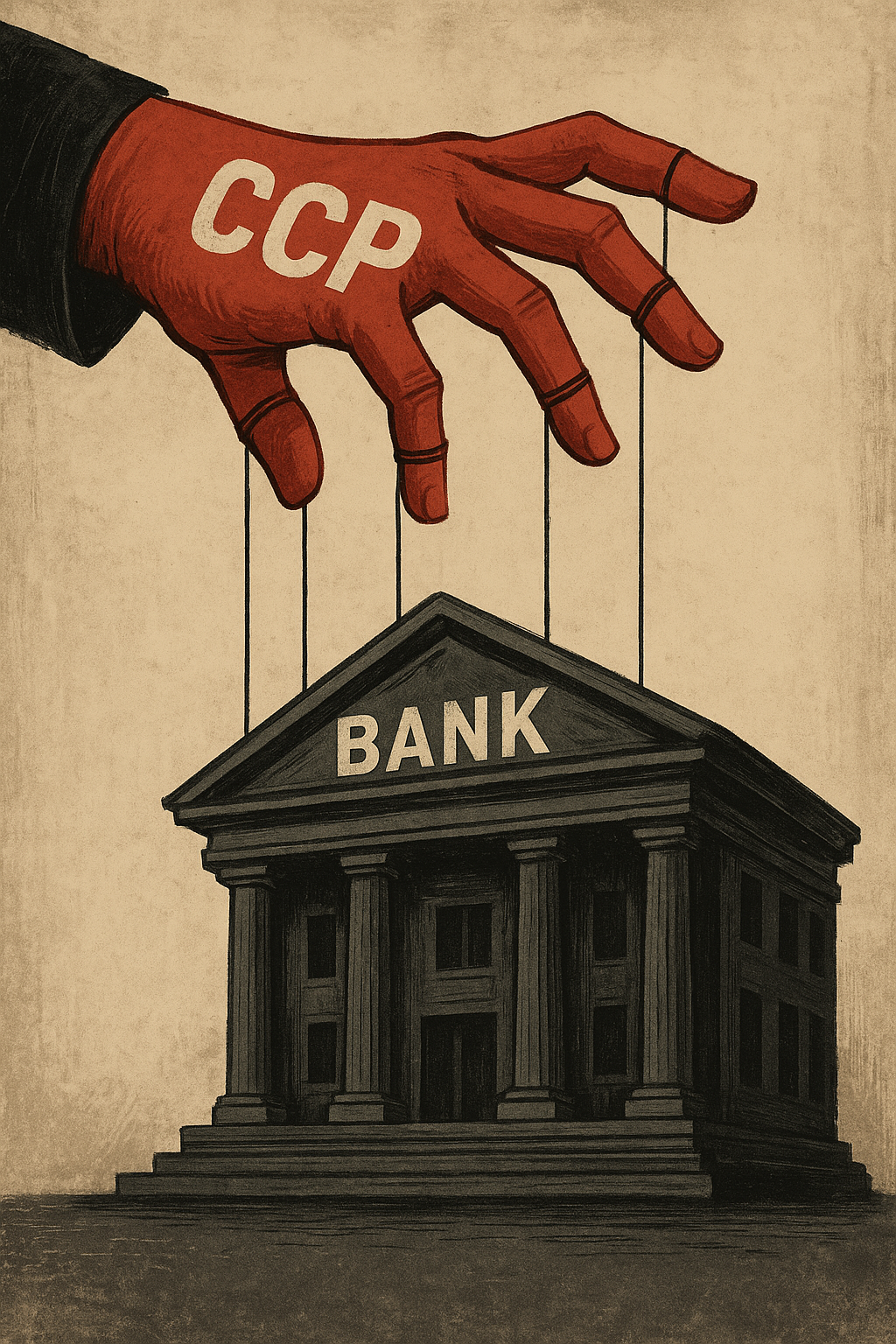

Beneath the surface, China’s massive local banking sector — the same system that financed the greatest urbanization project in human history — is starting to buckle. And if the rumors are true, the Chinese Communist Party (CCP) knows it’s worse than anyone wants to admit.

Empty cities cover China

The Ghost Town Debt Trap

How did it come to this? Decades of double-digit growth built entire cities from scratch. Local governments borrowed furiously, banks lent freely, and construction companies threw up high-rises as collateral for more loans. The model was simple: debt financed growth, which fueled more debt, which fueled more growth.

But every ghost city, every half-finished tower, every deserted shopping mall is really a tombstone for debt that can’t be paid back. Local government financing vehicles (LGFVs) — shadowy entities that mask official debt — now owe sums that, according to some leaked estimates, surpass $10 trillion USD. The real estate crisis only made it worse: defaulted developers, frozen pre-sales, and citizens who refuse to pay mortgages on apartments that may never be finished.

Insiders claim that some banks have up to 30% non-performing loans, but official figures hover around a polite 1.6%. A growing chorus of analysts whisper that these books have been cooked for years — the losses hidden, shuffled, and reclassified to keep the illusion of solvency alive.

Unknown Number of Empty Housing Projects Unfinished

Leaked Memos and Silenced Whistleblowers

Earlier this year, a confidential internal memo from a regional bank in Liaoning surfaced on the encrypted app WeChat before censors wiped it. The memo warned of “severe short-term liquidity strain” and recommended suspending large withdrawals. The whistleblower who leaked it? Gone. The account that posted it? Erased.

And then there’s the story of Zhang Wei, a mid-level risk manager for a provincial credit cooperative. He’d gathered internal reports showing that local real estate developers had defaulted en masse but the bad loans were still marked as performing. He tried to send those files to a foreign journalist through an encrypted drop. Days later, Zhang “fell” from his apartment balcony, the same day plainclothes men visited his building.

It’s not just the financial data that’s disappearing — it’s the people who know it best.

The Phantom Bailout: Who’s Really Paying?

So if banks are hollowed out and local governments are buried under mountains of bad debt, why hasn’t the whole thing imploded yet?

Enter the phantom bailout — a silent rescue operation that never shows up in the official ledgers. Sources in Hong Kong’s financial sector whisper about special “liquidity facilities” quietly extended to certain regional banks. The People’s Bank of China (PBoC) is rumored to have pumped trillions of yuan into zombie banks through opaque “policy lending windows” and backdoor asset swaps.

Beijing insists these “liquidity injections” are normal. But what happens when the central bank props up institutions that can’t survive on their own? Some think this is the largest covert bailout in modern financial history — one that makes the 2008 TARP program look like a rounding error.

Meanwhile, villagers in rural provinces are told the problem is “technical.” Their accounts remain frozen for months. Some desperate depositors hire protest brokers to stage “bank runs” in provincial capitals, only to be rounded up and detained.

Numerous Rural Banking Protests Across China

Vanishing Officials, Sudden “Accidents”

It’s not just whistleblowers who’ve vanished. In the past year alone, at least half a dozen mid-ranking party officials linked to local banks or LGFVs have died in so-called “accidents” — falls, drownings, “sudden cardiac events.”

One name keeps surfacing: Li Jun, a former provincial finance director rumored to have threatened to leak internal debt swaps that showed how “solvent” cities used creative accounting to mask default. He disappeared on his way to a business meeting in Macau last month. His car was found near a pier — keys still in the ignition.

Official statements are always the same: no foul play suspected.

Global Shockwaves and the Next Domino

Most Western analysts still shrug. “China will never let its banks fail,” they say. But the truth is, this time, the debts are too big — and too local — to paper over forever.

Foreign bondholders who lent to Chinese developers are already burned. But imagine if a wave of regional bank defaults hits a major urban center. Small businesses and exporters lose access to credit overnight. Real estate values plunge even further. Then, global supply chains seize up just as the world tries to recover from multiple crises.

In 2008, the global system caught pneumonia when Wall Street sneezed. In 2025, what happens if China’s shadow banking sector — four times the size of Lehman Brothers — catches fire from within?

The Looming Collapse

So What’s Next?

The CCP is playing for time. It wants to deflate this slow-motion collapse quietly, one hidden bailout at a time, one silenced leak at a time. It can’t afford an open panic — not with an aging population, youth unemployment near historic highs, and trust in the Party’s economic competence already wearing thin.

But rumors have a way of metastasizing. Already, encrypted groups share photos of closed teller windows and long lines at ATMs. The ghost towers keep multiplying. Local officials keep disappearing.

So watch the signals they hope you’ll miss: the frozen accounts, the suspicious deaths, the sudden liquidity “injections.” Because if China’s hidden banking collapse really does break the surface, the ripples won’t stop at its shores.

FINAL THOUGHT

Next time someone tells you China’s banks are “too big to fail,” ask them if they’ve ever walked through a ghost city at midnight — past towers that stand empty as silent markers of a debt no one can pay, and no one dares admit.

Source List

Official Data:

- National Bureau of Statistics of China: GDP & NPL stats — stats.gov.cn

- People’s Bank of China: Liquidity facilities — pbc.gov.cn

Key Media & Analysis:

- Financial Times (2025): China property crisis, ghost towns

- Reuters (2025): Local government debt & shadow banks

- Caixin Global (2025): Rural banks, non-performing loans

- Bloomberg (2025): Rumors of covert liquidity injections

- Radio Free Asia (2025): Rural protests, frozen deposits

- Hong Kong Free Press (2025): Missing officials & suspicious deaths

Global Risk Warnings:

- IMF (2025): Shadow banking contagion

- World Bank (2025): China debt vulnerabilities

Leaks & Rumors:

- Weibo & WeChat screenshots (archived) — Liaoning memo

- Anonymous Hong Kong finance blogs — “DragonLeaks” forums

- Whistleblower story: Zhang Wei, vanished banker

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/kz/register-person?ref=K8NFKJBQ

Need some online sabong action! Is OnlineSabongBet legit? Looking for a trustworthy place. Give it a go onlinesabongbet.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.info/id/register-person?ref=UM6SMJM3

Yo, anyone tried 88online66? I’ve been browsing around and their site looks pretty slick. Thinking of throwing a few bucks their way. If you give it a whirl let me know your thoughts! Find out more: 88online66.

Luckycasinogratis, what a name! Some games are available for testing, that’s cool! Maybe it will bring more luck to you! luckycasinogratis

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Vnq8 is my favorite for football bets. They’ve got tons of options, the odds are top-notch, and cashing out is super easy. Been having a good run there. Give them a go if you’re into sports betting. vnq8

Win44app is a gem! I love the mobile app because I can play anytime and anywhere. Easy to use and fast payments. Highly recommend giving it a shot, you might just hit the jackpot. win44app

Xanh9vn has some pretty sweet promotions running. The interface is modern, and I’m really enjoying the overall experience. It’s worth trying out if you want something fresh. xanh9vn

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.info/de-CH/register?ref=W0BCQMF1

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Looking for the Super 9 game download, eh? Fair enough. Head over to their site and see if they offer a direct download. Easy peasy. Get it here super 9 game download.

Trying to log in to Jiliplay999 dot com! Hope it’s easy to navigate, some sites are just a pain. Wish me luck! Login here jiliplay999.com login.

Hanap ko ay matinding saya, baka sa ninong gaming casino ko yan makita! Wish me luck, mga ka-tropa!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.